Neteller Available Countries

- Neteller Available Countries Vs

- Neteller Card Available Countries

- Neteller Available Countries Now

- Where To Use Neteller

This can be done using any available payment method in the “Money in” section of your account, or simply by receiving funds from either another Neteller customer or from a merchant by withdrawing funds. Please note that the available payment methods differ from country to country as all options are not available everywhere.

Shop securely, transfer money anywhere in the world, access your funds instantly. Trusted by millions. Join for free What is NETELLER? Pay online with confidence. You can trust NETELLER for fast and secure online payments. Paying with NETELLER is. Please choose your experience: × International. العَرَبِية Deutsch; Ελληνικά. Money Transfer Services Skrill. Skrill Money Transfer. Send money to an bank account for free with Skrill Money Transfer. Check which countries and payment methods are available from the list below.

Below we have set out a detailed analysis of all the fees and limits that Neteller charges to use their service.

It is important to know that the fees and limits that are applied have many variables such as verification status, VIP status and currency of Neteller account.

Therefore, the fees and limits we summarise below are based on the following assumptions:

- Your Neteller account is verified

- Your Neteller account currency is USD

If your account is in a different currency to USD, you can estimate fees and limits based on current exchange rates.

As your VIP level increases at Neteller, you will pay lower fees and have higher limits available.

The best way to view your current personal fees and limits is by logging into your Neteller account and checking directly.

Whilst Neteller is a great ewallet choice for most players regardless, we would also like to make you aware of the additional benefits of joining Neteller via us:

- Instant Bronze Pro VIP

- Fast Track to Silver VIP - $6000 USD requirement instead of $15,000 USD

- Increased Limits & Reduced Fees

- Easier VIP targets for higher levels of VIP

- Fast Track verification – 24 hours

- Verification without deposit

- Access to our Neteller rewards program

Neteller Deposit Fees

There are a substantial variety of options to make a Neteller deposit ranging from regular methods such as bank transfer and credit/debit cards to more flexible options such as funding your Neteller account with Skrill.

Fortunately, Neteller have simplified the fee structure.

- For all deposit methods an upload fee of 2.5% will apply if the deposit is less than $20,000 USD.

- For all deposit methods the upload fee will FREE if the deposit amount is $20,000 USD or higher.

The rules regarding a Neteller Mastercard deposit are different to every other deposit method. Whilst the same fee of 2.5% applies, there are some restrictions in place which limit where you can transfer funds deposited into Neteller with a Mastercard.

Neteller Deposit Limits

As explained above, the fee for uploading funds into your Neteller account is 2.5% for deposits less than $20,000 USD and free for all deposits over $20,000.

You can check the full list of deposit methods here.

Again, we have to remind you that your own personal Neteller limits will be determined by a number of factors such as VIP status, currency and type of account.

Neteller Available Countries Vs

Would you like reduced fees, increased limits and more? If so, please complete the Neteller VIP application form at the bottom of this page to get your FREE VIP Bronze Pro Upgrade

To find out the minimum and maximum limit of any deposit method just complete the following steps:

Neteller Card Available Countries

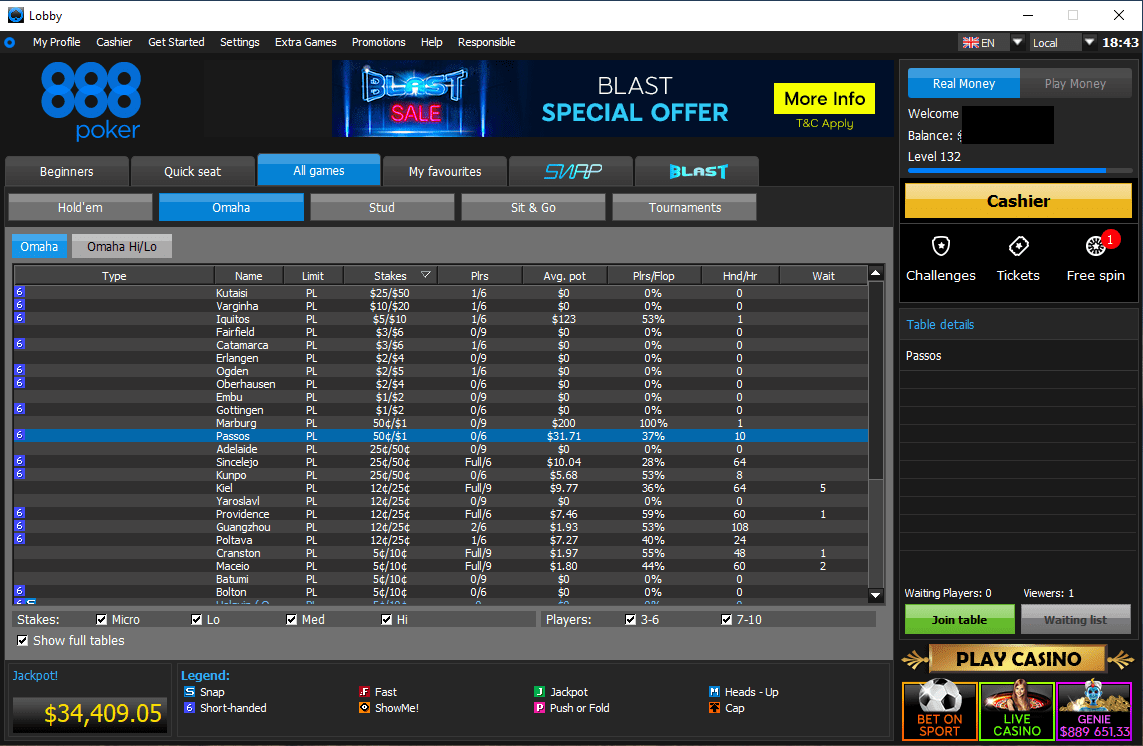

- Login to Neteller and go to Money In

- Click on your preferred deposit method. In this example we will use Rapid Transfer.

- Underneath the ‘Enter amount’ box you will be able to see the minimum and maximum deposit amount using this specific deposit method. In our example (of a verified but Non-VIP account) the minimum deposit is $1.21, and the maximum deposit is $6,044.85.

Neteller Withdrawal Fees

There are 5 different withdrawal options offered by Neteller and each option has a different fee.

| Fee | |

|---|---|

| Bank Transfer | $10 USD |

| Member wire | $12.75 USD |

| Merchant sites | Free |

| Money Transfer | See P2P fees |

| Net+ Prepaid Mastercard | 1.75% / $6USD |

| Skrill | 3.49% |

The withdrawal options listed on NETELLER’s website need to be analysed more carefully to understand clearly what they mean because two of the options are not really valid options to withdraw your funds.

- MERCHANT SITES – This is using your Neteller account to transfer/deposit at a merchant such as a casino, forex broker, poker site etc. Therefore, this is not actually a valid withdrawal option.

- MONEY TRANSFER – Again, this is listed as a withdrawal option but a Neteller Money Transfer means transferring from your Neteller account to another Neteller member account so again it can be argued this is not really a viable withdrawal option

The best way to withdraw your funds from your Neteller account is via bank transfer/member wire or by using your Prepaid Mastercard.

Please remember that as with all fees and limits, the amount you will be charged will depend on your VIP status. For example, Gold VIP and higher receive free withdrawals to your bank account.

Neteller Withdrawal Limits

Your Neteller withdrawal limits depend on which withdrawal method you request. For instance, for a regular verified customer with a USD account requesting a withdrawal via bank transfer (the most common method) you can request a minimum of $20 and a maximum of $100,000 per transaction.

If you live in any of the SEPA (Single Euro Payment Area) countries, you can request a bank transfer withdrawal. If your country is not in SEPA then you can request a withdrawal via Member Wire.

Withdrawals via Member Wire have similar limits to bank transfer but are slightly more expensive with a $12.75 fee.

Your Neteller Mastercard withdrawal limit will be based on your VIP status and will range between $1,000.00 - $3,300.00 every 24 hours. More details are below.

To request a withdrawal, login to Neteller and navigate to Money Out.

Neteller MasterCard Fees

Neteller offer two different prepaid card options for you to use: Net+ Prepaid Mastercard & Net+ Virtual Prepaid Mastercard. The fees and limits for both cards differ, as we have set out below.

The Net+ Prepaid Mastercard and Net+ Virtual Prepaid Mastercard are only available to customers in EEA countries and the UK.

As of November 2020, Neteller started issuing Net+ Cards in EUR currency only.

The information related to Net+ Card fees is in EUR.

If your account is not in EUR, the fee will be the currency equivalent.

Although the Net+ Cards are issued in EUR only, if your account is a currency different than EUR, you won't be charged FX conversion fees. For example if your Neteller account is USD, you will not pay for the foreign exchange conversion when you spend money using your USD balance.

Find out how to avoid paying Neteller FX fees with your prepaid Net+ MasterCard.

Net+ Prepaid Mastercard Fees & Limits

Your fees and limits relating to your Neteller Card will be determind by your VIP level and currency.

| Non VIP | Silver | Gold | Diamond | Exclusive | |

|---|---|---|---|---|---|

| Net+ MasterCard application | $10 | Free | Free | Free | Free |

| Replacement fee | $10 | Free | Free | Free | Free |

| Cash withdrawal limit | €900/per day | €900/per day | €3,000/per day | €3,000/per day | €3,000/per day |

| FX fee | 3.99% | 3.19% | 2.79% | 2.39% | 1.29% |

| ATM withdrawal fee | 1.75% | 1.75% | 1.75% | $6 | $6 |

| POS limit | €2,700/per day | €2,700/per day | €7,000/per day | €7,000/per day | €7,000/per day |

| Annual fee | $10 | Free | Free | Free | Free |

Net+ Prepaid Virtual Mastercard Fees & Limits

Your fees and limits for your Neteller Virtual card are set according to whether your account is verified or unverified.

As with the Net+ Prepaid Card, VIP members will pay lower FX, and card order fees and have higher limits than standard non-VIP members.

| Fee/Limit | |

|---|---|

| Order card | Free |

| Cancelled card replacement | $2.50 USD |

| Maximum per transaction | €2,700 |

| Maximum purchases/24 hours | 10 |

| Maximum POS purchases/24 hours | €2,700 |

Neteller To Neteller Transfer Fee

There have been numerous changes to the Neteller P2P fee recently.

However, we now believe that the current fee structure for transferring from one Neteller account to another Neteller account has stabilised and we will not see future changes to this fee anytime soon.

To summarise, the key points regarding the Neteller P2P fee structure are as follows:

- The P2P fee level depends on your Neteller VIP status – If your account is Silver VIP or higher then P2P transfers are FREE.

- If you are not Silver VIP or higher, the Neteller P2P fee will depend on when you registered and whether you have made a valid deposit.

| Non VIP (without valid deposit) | Non VIP (with valid deposit) | Silver VIP status | Gold VIP status | Diamond VIP status | Exclusive VIP status | |

|---|---|---|---|---|---|---|

| Customers registered before 18 March 2020 | 10% min. €20 on 1st transfer / 1.45% subsequent transfers | 1.45%, min €0.50 | Free * | Free | Free | Free |

| Customers registered between 18 March - 7 April | 10% min. €100 on 1st transfer / 2.99% subsequent transfers | 1.45%, min €0.50 | Free * | Free | Free | Free |

| Customers registered after 8 April 2020 | 4.49%, min €0.50 | 1.45%, min €0.50 | Free * | Free | Free | Free |

| Receive Skrill-to-Skrill transfer | Free | Free | Free | Free | Free | Free |

* Money Transfer fee of 1.45% is applied to members of certain countries and VIP levels.

Neteller to Neteller transfer limit

The minimum amount for P2P transfers in the past was $5 USD or currency equivalent.

However, ever since Neteller launched their new dashboard at the end of 2020, the minimum amount you can transfer now is as little as $0.01.

The maximum, as with all transfers, fees and limits, depends on your VIP level.

However, the most basic verified account should allow you to transfer up to $50,000 per P2P transfer.

There is no limit in the amount you can receive via P2P Neteller transfer. The maximum amount you can receive will be set by how much the sender is allowed to transfer.

Neteller To Skrill Transfer Fee

Many customers use more than one ewallet to manage their bankroll. After Skrill & Neteller merged in 2015 under PaySafe Ltd, customers have been able to take advantage of direct transfers between their Skrill & Neteller accounts.

In the past you could transfer from Skrill to Neteller for a 2.5% fee and transfer from Neteller to Skrill for 1%.

From 22nd February 2021, the fee for depositing at Neteller from Skrill (and vice-versa) will be 3.49%.

How to send money from Neteller to Skrill?

The way you deposit at Neteller using Skrill and vice-versa is actually what you might call a 'reverse deposit' because you have to withdraw from one ewallet to the other to deposit.

- Login to the Neteller account you want to use to deposit at Skrill and click on 'Money out' from the menu on the left-hand side.

- Select Skrill as the withdraw method.

- Enter the withdrawal amount and the email address of the Skrill account to want to deposit to.

- Complete the steps and confirm the transfer.

Neteller FX Fees

Neteller uses OANDA for the daily interbank market rate for currency conversions. Therefore, you can be reassured that you are always getting a competitive and fair interbank currency exchange rate whenever you make a transaction that requires a currency conversion.

The standard Neteller foreign exchange fee for all transactions involving a currency conversion is 3.99%.

However, if you are a Neteller VIP your currency exchange rate can be as low as 1.29%, depending on your VIP level.

Below you will find the Neteller Forex fees per VIP Level.

| Non VIP | Silver | Gold | Diamond | Exclusive | |

|---|---|---|---|---|---|

| FX conversion fee | 3.99% | 3.19% | 2.79% | 2.39% | 1.29% |

Don't forget to complete the Neteller VIP application form at the bottom of this page to get your FREE VIP Upgrade for reduced fees and increased limits and more!

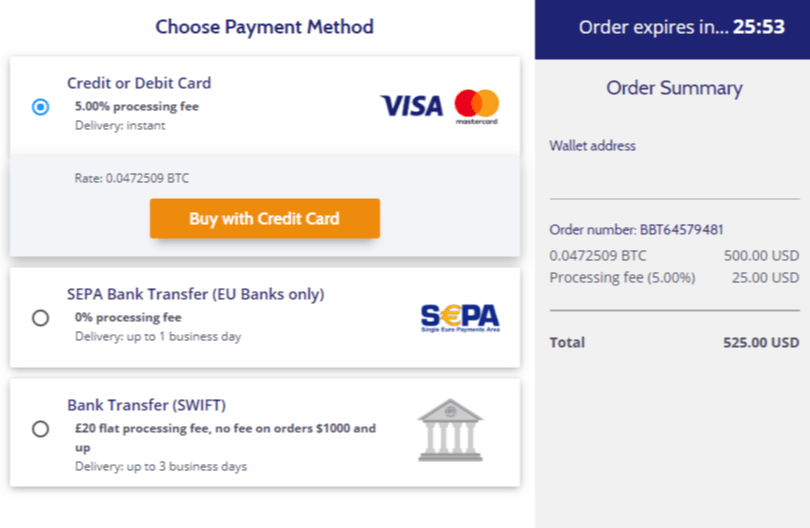

Neteller Bitcoin Fees

In 2018, Neteller improved their service to cater for those customers interested in Bitcoin and other cryptocurrencies by launching their crypto service.

Unfortunately you can no longer deposit into Neteller directly using Bitcoin or any other cryptocurrencies.

Buying & selling cryptocurrency fees

Depending on what currency your Neteller account is in, you will pay a different fee.

| Up to $19.99 | $20.00 - $99.99 | $100+ | |

|---|---|---|---|

| Buy cryptocurrency | $0.99 per transaction | $1.99 per transaction | 1.50% per transaction |

| Sell cryptocurrency | $0.99 per transaction | $1.99 per transaction | 1.50% per transaction |

| Crypto P2P | 0.50% per transaction | 0.50% per transaction | 0.50% per transaction |

Neteller Admin Fees

There are a number of additional fees that Neteller charge. Whether you are considering opening a Neteller account or you are a longstanding existing customer, it is useful to consider these additional fees to see whether you are affected.

99.99% of people will rarely, if ever, encounter any of the Neteller administrative fees but we have provided the information just in case you need it.

All the official documentation provided by Neteller with regards to their administrative fees can be found in the Neteller terms and conditions.

| Fee | |

|---|---|

| Inaccurate or untruthful information & lack of cooperation | up to $150 per instance |

| Chargeback fee | £25 GBP per chargeback |

| Prohibited transactions fee | up to $150 per instance |

| Reversal of a wrong transaction fee | up to $25 per reversal |

Neteller Available Countries Now

Inaccurate or untruthful information & lack of cooperation: $150.00 USD

When you register at Neteller you have to agree to their terms and conditions which set out in section 4.1.3 that when you open an account you must provide accurate and truthful personal information. If you are found to have provided inaccurate or untruthful information and do not cooperate as instructed by Neteller within 6 months, then they reserve the right to charge you a fee of up to $150 USD. T&C's 4.1.3.

To be frank, this is very unlikely to ever affect any members, but it is useful information to know, nonetheless.

Chargeback fee: £25.00 GBP

If you make a Neteller deposit from a payment method, such as credit card, that allows you to claim funds back via a chargeback and the reason for the chargeback is anything other than unauthorised use of your card, Neteller will charge you £25.00 GBP or equivalent. T&C's 10.

Where To Use Neteller

Prohibited transactions fee: $150.00 USD

This fee mainly affects customers who are operating an account for business related purposes. Essentially if you are receiving funds for any of the following categories then you could be liable to pay this fee while Neteller investigates your account.

Excluded Categories

- Money exchange

- Remittance businesses

- Bureaux de change

- Currency exchanges

- Purchase of travel money

- Collection of any form of donations or payments to charitable or not-for-profit organisation dealing in natural resources such as jewels, precious metals or stone

- Live streaming

- Sale or supply of alcoholic beverages

- Sale or supply of dietary supplements and alternative health products

Please note that the excluded categories are not solely limited to the list above. Our advice is that if you are unsure as to whether your business activities may be prohibited to get in contact with Neteller to clarify with them. T&C's 14.6.

Incorrect Transaction Reversal Fee: $25 USD

When you request a withdrawal from Neteller via the money out options you should always take great care when entering bank details, IBAN, BIC etc details, especially so if the withdrawal is for a large amount.

If you enter incorrect details and the payment is sent to the wrong place you can request Neteller to help you with recovering of the funds. However, an administrative fee of up $25 will apply. Please note that paying the administrative fee does not guarantee that your funds will be returned so again, please take the upmost care when requesting bank withdrawals. T&C's 6.5.13.

Related articles

Neteller VIP Upgrade Form

Join Neteller using the application form below or submit your existing Neteller details to link your Neteller account to eWalletBooster.com and take advantage of lower fees, increased limits and much more. New & Existing Neteller customers welcome.

Send money to an bank account for free with Skrill Money Transfer.

Check which countries and payment methods are available from the list below.

Supported countries

So far you can send money to the following countries, using the payment method available in your region:

| Recipient Country | Receive Option | Receive Currency |

|---|---|---|

| Australia | Bank account | AUD |

| Austria | Bank account | EUR |

| Bangladesh | Bank account | BDT |

| Belgium | Bank account | EUR |

| Cyprus | Bank account | EUR |

| Estonia | Bank account | EUR |

| Finland | Bank account | EUR |

| France | Bank account | EUR |

| Germany | Bank account | EUR |

| Greece | Bank account | EUR |

| India* | Bank account | INR |

| Indonesia | Bank account | IDR |

| Ireland | Bank account | EUR |

| Italy | Bank account | EUR |

| Kenya | Bank account, Mobile wallet | KES |

| Latvia | Bank account | EUR |

| Lithuania | Bank account | EUR |

| Luxembourg | Bank account | EUR |

| Malaysia | Bank account | MYR |

| Malta | Bank account | EUR |

| Mexico | Bank account | MXN |

| Monaco | Bank account | EUR |

| Nepal | Mobile wallet, Bank account | NPR |

| Netherlands | Bank account | EUR |

| Nigeria | Bank account | NGN |

| Pakistan | Bank account | PKR |

| Philippines | Mobile wallet, Bank account | PHP |

| Portugal | Bank account | EUR |

| Poland | Bank account | PLN |

| San Marino | Bank account | EUR |

| Slovakia | Bank account | EUR |

| Slovenia | Bank account | EUR |

| Spain | Bank account | EUR |

| Sri Lanka | Mobile wallet, Bank account | LKR |

| Thailand | Bank account | THB |

| United kingdom | Bank account | GBP |

| Vietnam | Bank account | VND |

*Senders from India cannot send to India

Global payment methods

Paysafecash

- Paysafecash

Card Deposits - Visa and Mastercard available in all countries

- Credit Card Visa

- Credit Card MasterCard

Bank transfer:

Klarna: available in Austria, Belgium, Germany, Italy, Spain, Netherlands

Rapid Transfer: available in Austria, Denmark, Finland, France, Germany, Hungary, Italy, Norway, Portugal, Spain, Sweden

- Klarna

- Rapid Transfer

Send money, receive money

International Transfer

FreeNo fee when you use Skrill Money Transfer to send money to an international bank account.

International transfer in the same send and receive currency only

International transfer exchange rate mark-up

Up to 4.99%Exchange rate mark-up fee per transaction.

Domestic Transfer

Up to 2%Domestic fee per transaction. This fee will be charged when the transfer begins and ends in the same country.

Receive money

FreeSkrill Money Transfer does not charge recipients any fee to receive